pa local tax filing deadline 2021

Harrisburg PA The Department of Revenue is reminding the public that the deadline for filing 2020 Pennsylvania personal income tax returns and making final 2020 income tax payments is May 17 2021. Annual Earned Income Tax Reconciliation.

Pennsylvania Sales Tax Small Business Guide Truic

The deadline for filing 2021 federal and state income tax returns this year will be April 18 instead of April 15 because of a government holiday celebrated in Washington DC.

. Keystone Collections said today The Local Earned Income Tax filing deadline has NOT been extended beyond the April 15 2021 due date. However Michael Herzog JD the tax expert. Pennsylvania Extends Personal Income Tax Filing Deadline to May 17 2021.

The local earned income tax filing deadline is accordingly extended to match the State and Federal date of May 17 2021. All residents of Adams County and all residents of York County except West Shore School District file their annual earned income tax returns with YATB. As of right now the Local Earned Income Tax filing deadline has NOT been extended beyond the April 15 2021 due date.

During these trying times of COVID-19 we here at Capital Tax want to wish everyone health and be safe. We are the trusted partner for 32 TCDs and provide services to help Individuals Employers Payroll Companies Tax Preparers and Governments. Replies 47 Shutterstock HARRISBURG PA Gov.

While the PA Department of Revenue and the IRS announced that income tax filing deadlines for their 2020 final returns are extended to May 17 2021 no such change has been made for the Local Earned Income Tax Filing deadline. Quarterly Earned Income Tax Return and Payment. Tom Wolf has signed into law a bill that extends the personal income tax filing deadline for.

The 2021 Earned Income Tax annual return deadline was April 18 2022. The IRS and PA Department of Revenue extended the tax filing deadline for the 2020 final returns to May 17 th 2021. Extended Tax Filing Due Date.

That is Keystone will not apply late-filing penalty and interest on tax year 2020 final returns filed between April 15 2021 through May 17 2021. Pennsylvania Act 32 of 2008 is a law that reforms and standardizes the local Earned Income Tax system. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by April 18 2022.

The Internal Revenue Service pushed back the filing deadline for taxes to May 17th. The department will be able to process 2021 personal income tax estimated payments made in 2021 if taxpayers complete and mail a PA-40ES I Declaration of Estimated Tax coupon to the department along with their check for the estimated tax amount. Penalty and interest that already accrued prior to April 15 2021 remains due.

Harrisburg PA The Department of Revenue today announced the deadline for taxpayers to file their 2020 Pennsylvania personal income tax returns and make final 2020 income tax payments is extended to May 17 2021This means taxpayers will have an additional month to file from the original deadline of April 15. 11 rows BLAIR TAX COLLECTION DISTRICT. We specialize in all Pennsylvania Act 32 and Act 50 tax administration services.

2021 Personal Income Tax Forms. We are Pennsylvanias most trusted tax administrator. The Bureau also collects Local Services Tax.

Paper filed PA-40 returns can take 8-10 weeks from the. Online Payments for Individual Earned Income Tax Estimated Payments Final Return Extensions Individual Local Services Tax Payments and Real Estate Tax Payments are available at httpsdirectpay. The PA Department of Revenue and the IRS announced that the income tax filing deadline for the final annual return 2020 is extended to May 17 2021.

Taxpayers should write 2021 Estimated Tax Payment and the last four digits of the primary. The Internal Revenue Service also. Contact us to quickly and efficiently resolve.

In fact one-third of taxpayers. The local earned income tax filing deadline is accordingly extended to match the State and Federal date of May 17 2021. The new due date for 2020 Local Earned Income Tax Filings is MAY 17TH 2021.

The personal income tax filing deadline was originally set for today April 15 2021 but the department in mid-March announced an. The York Adams Tax Bureau collects and distributes earned income tax for 124 municipalities and school districts in York and Adams Counties. While the PA Department of Revenue and the IRS announced.

The deadline for filing your local tax returns has not changed. Delinquent Per Capita and Occupation. Keystone Collections Group collects current and delinquent tax revenue and fees for Pennsylvania school districts boroughs cities municipalities and townships.

Blair County Tax Collection. The Washington County Tax Collection District has appointed the Keystone Collections Group as the Tax Officer for the district.

Representative Dwight Evans Representing The 3rd District Of Pennsylvania

Where S My Refund Pennsylvania H R Block

Pennsylvania Department Of Revenue

Pennsylvania Department Of Revenue

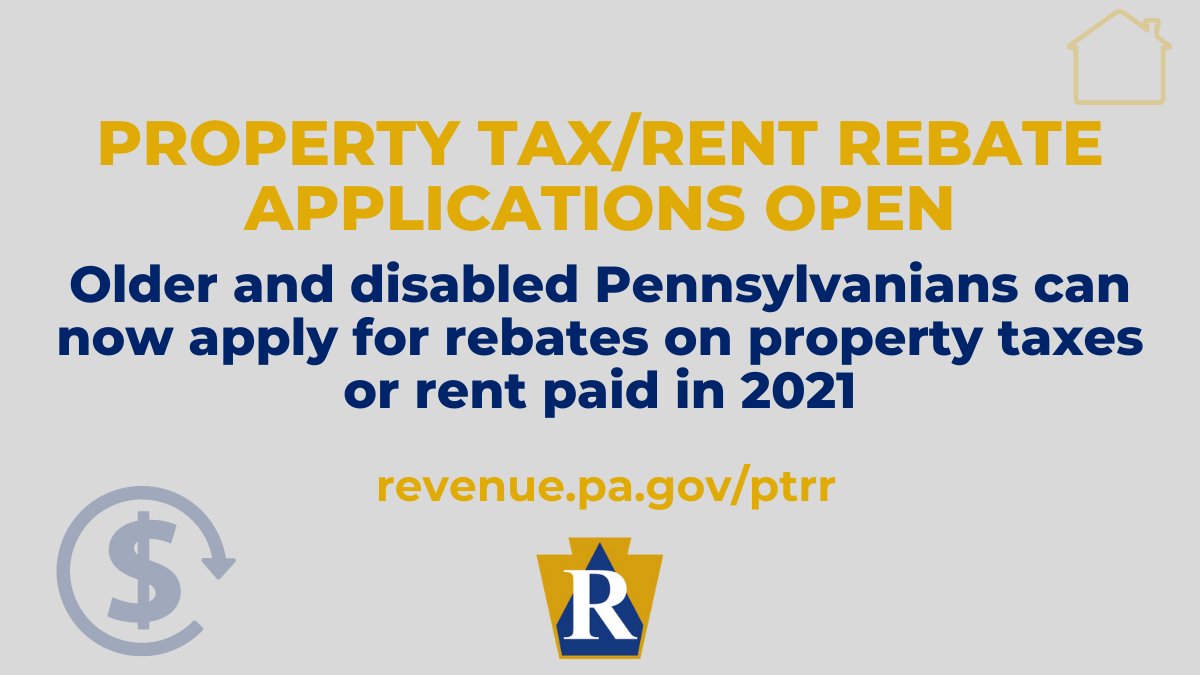

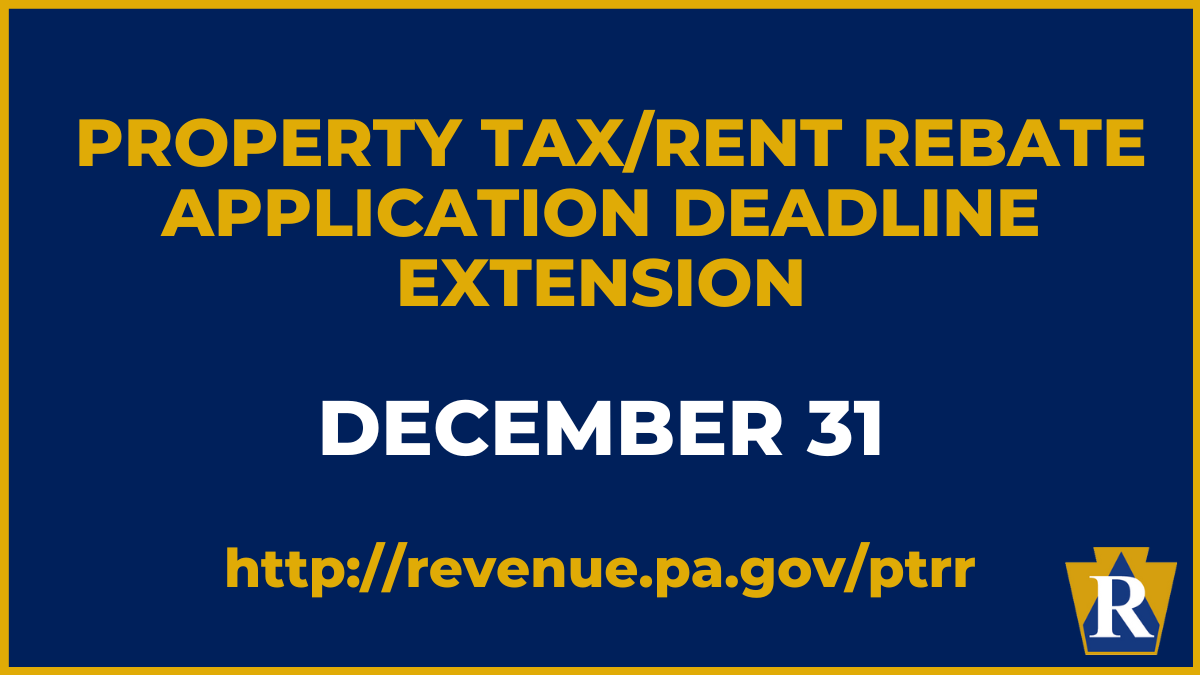

Pennsylvania Department Of Revenue Parevenue Twitter

Pennsylvania State Tax Refund Pa State Tax Brackets Taxact Blog

Pennsylvania Department Of Revenue

Pennsylvania Department Of Revenue Parevenue Twitter

Pennsylvania Department Of Revenue

Pennsylvania Department Of Revenue Parevenue Twitter

Pennsylvania Department Of Revenue Parevenue Twitter

York Adams Tax Bureau Pennsylvania Municipal Taxes

.png)